Your complimentary articles

You’ve read one of your four complimentary articles for this month.

You can read four articles free per month. To have complete access to the thousands of philosophy articles on this site, please

The Credit Crunch

Forever Blowing Bubbles

Mike Fuller on the circular cause of the credit crunch.

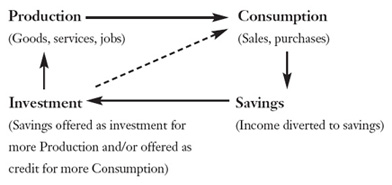

The global credit crunch has led to a spate of books trying to make its convolutions intelligible to the public. Robert Peston’s Who Runs Britain?, Niall Ferguson’s The Ascent of Money, Hugh Pym and Nick Kochan in What Happened? all do an excellent job in allowing the non-specialist to at least half-understand the role played in our current woes by arcane entities like shadow banking, credit default swaps, collateral debt obligations and special investment vehicles – those things which, in happier times Gordon Brown praised as the ingenious financial innovations of those brilliant folk in the City to whom we owe so much. But while these books are good are unravelling some of the intricate details, perhaps the deepest analysis of the crisis is contained in Graham Turner’s book The Credit Crunch. Turner analyzes the global financial crisis in the spirit of the great economists – those ‘worldly philosophers’ such as Adam Smith, Karl Marx and John Maynard Keynes – tying it into broader themes in economic theory and history. Implicitly if not explicitly, Turner relates the crunch to the Circular Flow of Income, that standard economist’s tool for analyzing the health and ills of any economy:

For any economy, national or global, to function effectively, it needs a smooth flow of finance between production, consumption, savings and investment. Economic problems occur when there is a lack of fit between these four elements. To give two examples: too much consumer demand for too little production (‘too much money chasing too few goods’) leads to inflation (‘demand-pull inflation’); while overinvestment, overproduction and underconsumption are a recipe for deflation, unemployment and recession (as many hold happened in the 1929 Wall Street Crash and subsequent Great Depression). To move closer to our own times, the opening up of the global economy to include former Soviet countries and much of Asia and especially China and India, with their huge populations, led to an immense recent boost in the productive capacity of the world (sometimes in old-fashioned sweatshops, more often high technology combined with cheap labour), and to new investment opportunities for corporations, financial institutions and shareholders in these new centres of production – nearly all of which focus on the production of cheap consumer goods for export to developed industrial nations like the US, the UK and Europe. There is a consequent loss of jobs and trade deficits in the developed industrial world, mirrored by gaining of jobs and trade surpluses in China, India etc. This inevitably threatens a crisis of overinvestment, overproduction and underconsumption on a global scale. You cannot reap all the benefits of your investment and production unless you can realize all this investment and production in sales to consumers – whether, say, you’re a Chinese entrepreneur; or a US company involved in foreign direct investment (ie actual production) in China, like Walmart; or a private investor or pension fund involved in portfolio investment (ie shares) in a UK company like Burberry, which has China-based production. As Graham Turner puts it:

“The credit bubble is the direct result of numerous companies in the West abusing free trade, moving jobs offshore simply to boost profit margins. It has not worked for Burberry, because companies need consumers to buy. Consumers need jobs to be able to buy their goods and services. And they cannot do that indefinitely by getting deeper into debt.” (The Credit Crunch, p.x).

Since so many potential consumers in the developed world are unemployed or underemployed due to loss of jobs to China etc, only credit can fill the gap to make global consumption equal global production. Credit flows through the international banks from the winners in the global economy (the savings of the Middle East, China, international investors) to the losers (people in the US, UK and Europe who have lost their jobs, have low-paid jobs, or are retired, and as a result are essentially bad credit risks). Such a credit bubble suits everyone, until the bubble inevitably bursts because the world as a whole is producing more goods and services than it can actually afford to buy. When the bubble bursts, the inflow of foreign capital ceases, banks have less money to lend, and thus we get the credit crunch and recession. To quote Turner again:

“As more and more companies fled the West in search of cheaper production bases, the central banks were obliged to keep interest rates low, to stimulate economic growth. The rise in debt was the flipside of jobs being lost to the East. Eventually, the credit bubble burst. As an economic strategy, it made little sense, even for the Burberrys of this world. After seven years of debt-fuelled growth, stock markets are now lower than they were in 2000. Free trade driven by cost cutting feeds and nourishes credit bubbles. It does not benefit the workers, but it has failed corporations too.” (ibid, p.x.)

Governments which actively encouraged low interest rates and credit-based economies, now look round for scapegoats. Who do they blame? They blame greedy and irresponsible bankers; incompetent regulators (who ironically had been pressured by government to adopt ‘light touch regulation’); American sub-prime mortgages and toxic loans; Chinese and Middle Eastern funds flowing into the West, encouraging careless lending; or Chinese manipulation of exchange rates to promote exports and discourage imports. But while such things may be the immediate causes of current problems, they are also merely symptoms of the underlying cause. This underlying cause has to do with imbalances in world trade and subsequent imbalances in the global circular flow of income.

Marx and Keynes

Karl Marx famously pronounced: “The last cause of all real crises always remains the poverty and restricted consumption of the masses as compared to the tendency of capitalist production to develop the productive forces in such a way that only the absolute consuming power of society would be their limit.” In a less well-known pronouncement, quoted in Vince Cable's 2009 book The Storm, Marx also predicted in Nostradamus-like fashion: “Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and mechanical products, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalised and the state will have to take the road which eventually will lead to communism.” He believed there was a fatal contradiction between the need for an ‘industrial reserve army’ of unemployed to keep wages and prices down (and profits up), and the incompatible need for high employment at good rates of pay to consume the full product (and keep profits up). Marx did not see how any juggling act within capitalism could resolve this contradiction with its attendant crises and human misery. This is why Marx thought that capitalism would eventually have to go, to be replaced by a more rational system of economics. True, he was not terribly clear about the details of this more rational economics, and so his professed followers (Lenin, Trotsky, Stalin, Mao, Castro, Pol Pot) had to more or less make it up as they went along, weaving an uncertain path between Marx’s ideas, historical expediency, and in the case of Stalin, Mao and Pol Pot, extreme megalomania.

To be fair, John Maynard Keynes too could not see how any such juggling act was possible within existant capitalism. But he did believe it was possible within a modified form of capitalism, which would then constitute the more rational system of economics apparently needed. I think it is fair to say that the essential features of this Keynesian model are, firstly, that the government should intervene in such a way as to manage demand in the economy as a whole (the macro-economy), mainly through the operation of its fiscal policy (taxation, government spending and borrowing) and its monetary policy (interest rates, credit). Meanwhile, the everyday activities of business people, workers and finance (the micro-economy) would be left free to operate along conventional market lines, within the broad parameters set by governmental macro-economic demand-management. This ‘Keynesian compromise’ between state control and the market meant, as J.K. Galbraith once sardonically put it, that now we could have a budget-deficit instead of a revolution.

In the 1930s and again in the 50s and 60s, Keynesian orthodoxy promoted a policy, broadly, of ‘being kinder to labour at the expense of capital’, because it was felt that this was the only way for capitalism to survive in the face of communist and fascist alternatives. But by the 1970s it was felt that all was not well with this ‘acceptable face of capitalism’, with its generous welfare state: it was inflationary, inefficient, complacent, and punitive to enterprise and wealth creation. In the 1980s there was a growing body of opinion that capitalism’s viability depended on ‘being kinder to capital at the expense of labour’. Hence many of the state interventionist policies instituted during the Thatcher/Reagan years were specifically designed to unfetter market forces (especially the free global flow of capital) and to make the economic world approximate more closely again to the ideas of the first great worldly philosopher, Adam Smith.

In the light of the current global crisis, as Graham Turner suggests (and Robert Peston to some extent agrees), perhaps the viability of capitalism depends again on ‘being kinder to labour at the expense of capital’ – that is, in restricting the power of international capital to seek its advantages at the expense of international labour. Henry Ford may have said that history was bunk; he may have disliked trade unions; but didn’t he also ask, if he didn’t pay his workers enough, how could they afford to buy his cars?

© Dr Mike Fuller 2009

Mike Fuller is in the Philosophy Department at the University of Bolton.